The Reality of the Derivatives Market Instructor: Elie Ayache Date & Time: Sunday, March 11, 18, 25, April 1 11 AM EST

DESCRIPTION

1. We present the Black-Scholes-Merton model of derivative pricing, the problem it has solved and the problem it has created (known as ‘the volatility smile problem’). This problem is very challenging, not only computationally but also theoretically and philosophically. It is the reason why critical thinkers of finance who are not familiar with it have a narrow view of the derivatives market and its meaning, especially in relation with the future.

2. We investigate the foundations of abstract probability theory. The concept or ‘random variable’, introduced by Kolmogorov in 1933, and its success in formally showing the strong law of large numbers, point to a conception of randomness that lies deeper than the intuitive view of randomness and random generators. It shows distinctions that thought has to make, when it thinks the world, between what we call the ‘concrete’ and the ‘real’. It is at this level of the archaeology of thinking that the category of money emerges. Money is an alternative way of wiring the logic of the concrete and the real, hence an alternative way of introducing the matter of contingency inside the formalism of possibility and probability.

3. We extend the argument from money to the material exchange of derivatives and their pricing technology. When the advent of the Black-Scholes-Merton model is interpreted as a technological revolution which involves actors (market-makers) and technological means (writing of derivatives), it is shown that the market, thus understood in its full writing capacity, recaptures the full concreteness of the world, and hence of the future, in ways that escape abstract probability theory. The consequence, however, is to give a new meaning to the word ‘reality’, which may be incompatible with the one issuing from possibility and probability.

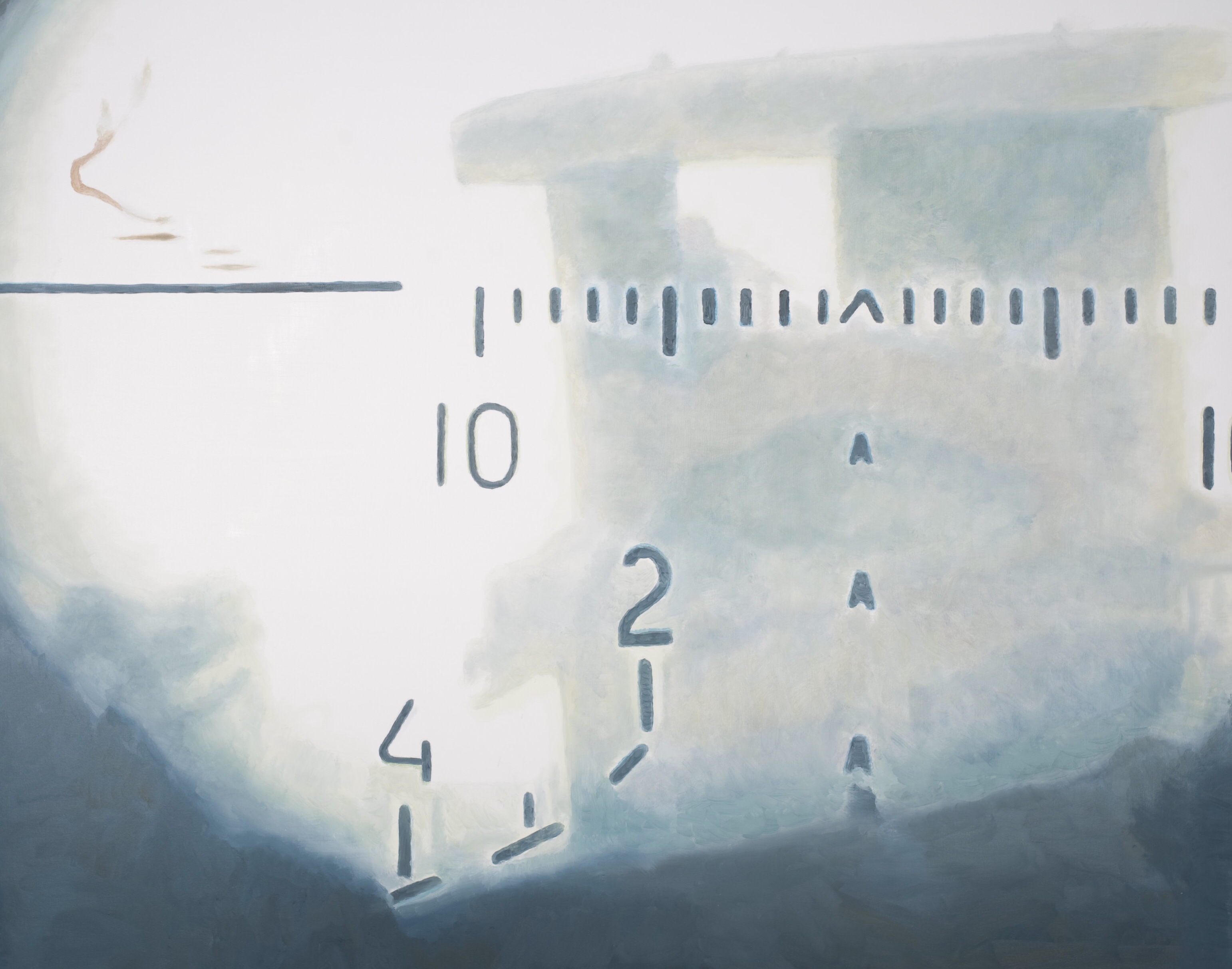

Image: Luc Tuymans, Sniper, 2009, Oil on canvas

You cannot enroll in this Seminar because it has already been completed. To become a Monthly Memebr of The New Centre and watch the related videos, click here to go to PayPal and subscribe:

To see The New Centre Refund Policy CLICK HERE.

To see The New Centre Refund Policy CLICK HERE.